michigan property tax rates by zip code

CLASSIFICATION AND TAX RATES Michigans General Property Tax Act the GPTA sets forth the classifications into which taxing jurisdictions must place all taxable property in the state4 This classification system assists in the equalization process which is designed to ensure that properties located in different. Taxes Assessing 2019 Tax Millage Rate.

Never Give Stores Your Zip Code Here S Why

Tax rates in Michigan are expressed as mill rates.

. Property taxes are an important tool to help finance state and local governments. Property Tax Calculator - Estimate Any Homes Property Tax. They run a full year.

Finally the per-capita property tax in the US is 1618Scroll down to find all about these vital property taxes by state segments. A mill is equal to 1 of tax for every 1000 of taxable value. Just enter the ZIP code of the location in which the purchase is made.

The state property tax contributes 3008 towards the overall income. On April 9 2018 the Michigan State Tax Commission released new recommended Property Classification CodesThese codes are to be listed each year on a propertys Notice of AssessmentThe classification of the property is critical for determining the deadline for filing a property tax appeal and whether an appearance before the March Board of Review is. In that same year property taxes accounted for 46 percent of localities revenue from their own sources and 27 percent of.

Enter Your Address to Begin. The summer tax bill runs from July 1st of this year to June 30th of next year. In fiscal year 2016 property taxes comprised 315 percent of total state and local tax collections in the United States more than any other source of tax revenue.

Our Michigan property tax bills cover. Start Your Homeowner Search Today. Monday through Thursday Jim Heaslip Assessor 810 632-7498 Email.

Search Valuable Data On A Property. Tax rates in Michigan apply to your propertys taxable value. Keep in mind that sales tax jurisdiction rules can sometimes be too complicated to.

The winter tax bill runs from December 1st of this year to November 30th of next year. BSA Property Tax Search. Ad Research Is the First Step to Lowering Your Property Taxes.

Personal Personal 003 Reference Special Acts Real Ref. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOOL 331314 511314 271314 391314 331314 511314 BLOOMINGDALE PUBLIC S 324042 503538 264042 383538 324042 503538 Clyde Twp 031040 FENNVILLE PUBLIC SCHO 304224 484224 244224 364224 304224 484224. On or after March 1 all delinquent taxes are paid to the Oscoda County Treasurer.

To find detailed property tax statistics for any county in Michigan click the countys name in the data table above. All current taxes that remain unpaid by March 1 become a delinquent tax. As of January 1 2022 the cost for individual record lookups will increase from 2 per record to 3 per record.

Browse Current and Historical Documents Including County Property Assessments Taxes. Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. If the delinquent tax remains unpaid until the following March 1 the property is put into forfeiture.

Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. The states average effective rate is 242 of a homes value compared to the national average of 107. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

The state government levies a statewide tax of six mills and additional rates are set by local government tax authorities such as city governments and school district. To access tax information you will need to enter you 10 digit parcel ID number beginning with either 14 or 19. This data is based on a 5-year study of median property tax rates on owner-occupied homes in Michigan conducted from 2006 through 2010.

The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States. The citys homes have a median market value of 47000 and a median property tax bill of 1671 according to the Census Bureaus five-year estimate for 2014-18. Such As Deeds Liens Property Tax More.

The total property tax as a percentage of state-local revenue is 1693 while the property tax percentage of personal income stands at 312. Total taxable value. Code Description Type Category.

West Bloomfield Township had a total taxable value of 3561180050 in 2018 of which 89 is residential property. 001 Retired Split Combined Ref. If you attempt to use the link below and are unsuccessful please try again at a later time.

772 to 653 mills. West Bloomfield Township Oakland County. Property Tax Estimator and Millage Rates The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

24 Hour Tax Hotline - Property tax information is now available Free on the Oakland County 24 Hour Tax Hotline by dialing 248-858-0025 or toll free number 1-888-600-3773. A 4 administration fee is added and 1 interest. State Tax Commission Recommended Classification Codes.

Adopted by the STC April 9 2018. Homeowners and current residents can view their information free of chargeYou must have a BSA Online account in order to access your information for free. 300 charge for all others.

To add more confusion to the process is every city does their wintersummer taxes differently. Real Real 002 Reference Personal Ref. Hartland Township Hall 2655 Clark Road Hartland Michigan 48353.

To calculate your Village tax bill based upon the Village you will need your propertys 2020 Taxable Value and use the following formula. The 2020 Tax Millage Rate for Village of Holly residents is 121596 mills. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected.

Ad Get In-Depth Property Tax Data In Minutes.

Auto Insurers Often Charge Identical Neighbors Considerably Higher Premiums Because Of Zip Code Differences Consumer Federation Of America

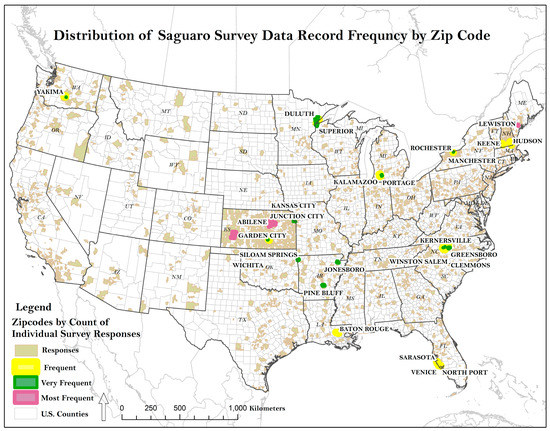

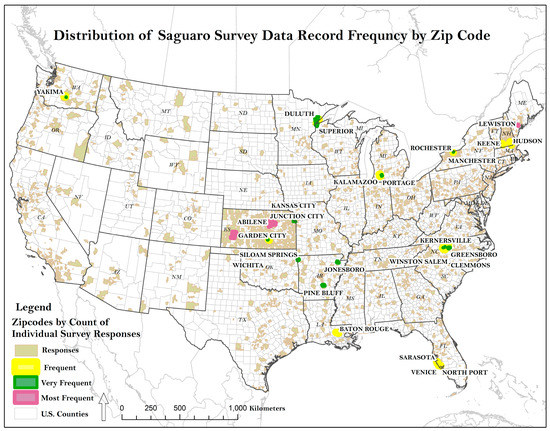

Sustainability Free Full Text A Geographic Information System Gis Based Analysis Of Social Capital Data Landscape Factors That Correlate With Trust Html

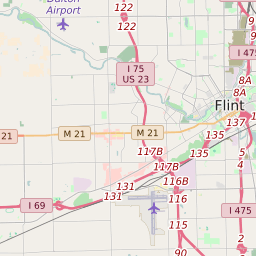

Zip Code 48507 Profile Map And Demographics Updated April 2022

Sell My House Fast Omaha We Buy Houses Omaha 402 Homebuyers Llc Sell My House Fast Sell My House We Buy Houses

Zip Code 48507 Profile Map And Demographics Updated April 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

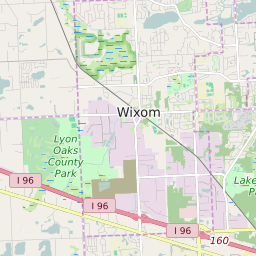

Zip Code 48167 Profile Map And Demographics Updated April 2022

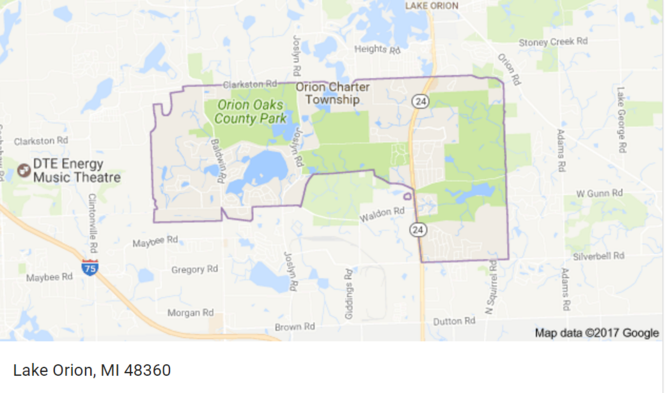

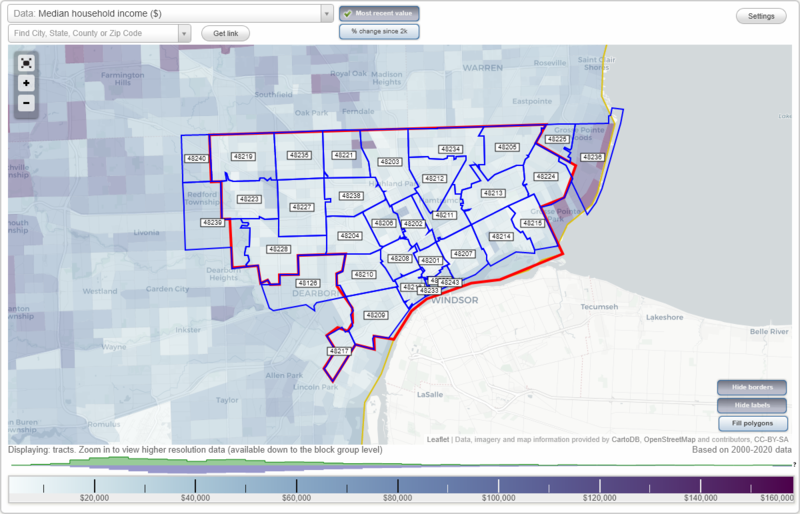

Michigan S 50 Wealthiest Zip Codes Based On Irs Data Mlive Com

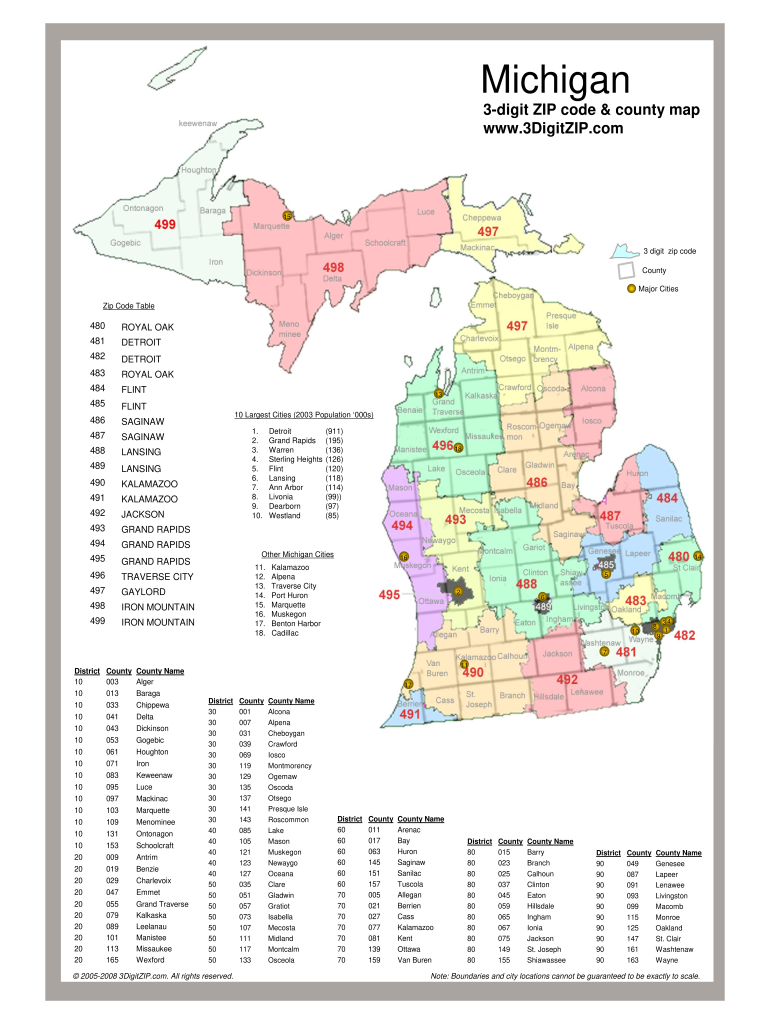

Michigan Zip Code Map Fill Online Printable Fillable Blank Pdffiller

Are You Retired With An Indexed Universal Life Or Whole Life Insurance Payout Is It Good Life Insurance Policy Compare Quotes Insurance Quotes

Michigan S 50 Wealthiest Zip Codes Based On Irs Data Mlive Com

Zip Code 49841 Profile Map And Demographics Updated April 2022

Zip Code Housing Price Index Fastest Housing Price Change Housing Value Appreciation

Detroit Michigan Mi Zip Code Map Locations Demographics List Of Zip Codes

Amazon Com Detroit Michigan Zip Codes 48 X 36 Laminated Wall Map Office Products

Zip Code Urban Rural Geography Demographics

Zip Code 49512 Profile Map And Demographics Updated April 2022

Lansing Michigan Mi Zip Code Map Locations Demographics List Of Zip Codes

Link To Data Analysis Bankruptcy And Race In America Data Analysis Analysis Race In America